New tool helps Chamber track local industry data

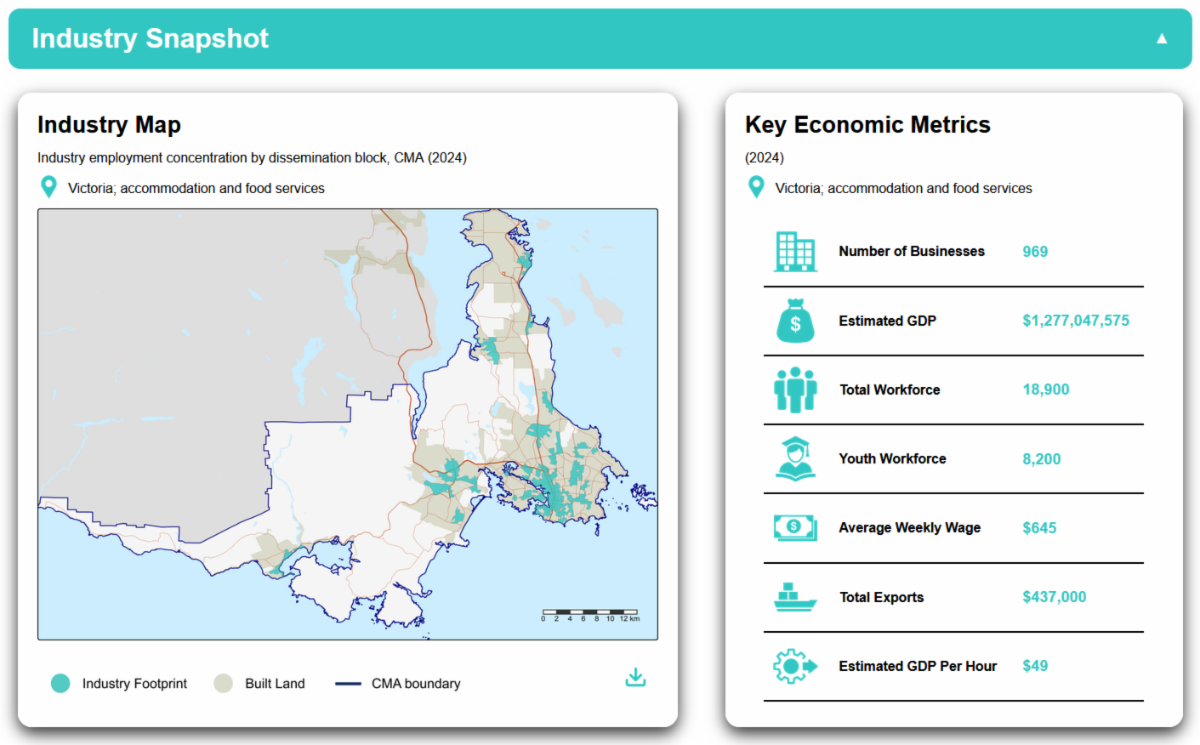

The Canadian Chamber has released a new tool to help understand the geographic and economic footprint of different industries on regions across the country.

The Business Data Lab’s Canadian Industry Tracker is available to chambers that are part of the national network. The tracker combines economic, workforce, trade, productivity and business outlook indicators — many not previously available at the city level. The data shows how major Canadian industries are performing across 41 census metropolitan areas, including Greater Victoria.

The tracker helps the Chamber’s team benchmark industries, compare regions and spot emerging strengths and risks. That knowledge helps in our advocacy and our partnerships with other community organizations working on behalf of business.

“Our Chamber has always punched above our weight with the advocacy we do to all levels of government, and this tool along with additions to our staff to increase our capacity around advocacy will help us to continue that work,” Chamber CEO John Wilson said.