No one knows what the future holds, but that doesn’t mean we can’t take a shot at forecasting what’s to come. Here, with the help of the Canadian Chamber’s Business Data Lab, are Chief Economist Stephen Tapp’s eight predictions for the economy. Note that the following list is edited and condensed for space. Read the full article here.

1. Affordability will remain a key consumer and political concern

A big story in 2024 was that inflation was tamed faster than expected — the “soft-ish landing” few economists thought possible. But there are no victory parties planned. Prices are up almost 16% since 2020, and even more, for some essential items such as food and shelter. Politicians will keep searching for policy solutions ahead of the upcoming federal election.

2. Work stoppages will remain elevated

Take rising unit labour costs for businesses, add in workers’ anxieties about affordability and automation, and the result has been a huge increase in work stoppages over the past two years. The last time we had this many work stoppages was almost 40 years ago. Expect this trend to continue in 2025.

3. Immigration will slow down, but the government won’t hit its 2025 target

After pandemic lockdowns lifted, Canada significantly increased immigration, led by non-permanent residents. After a policy U-turn last year, Canada’s population growth is on track to go into reverse in 2025, causing a significant drag on headline economic growth. I would be surprised if, in an election year, the government hits the ambitious target to slow immigration this much, this fast.

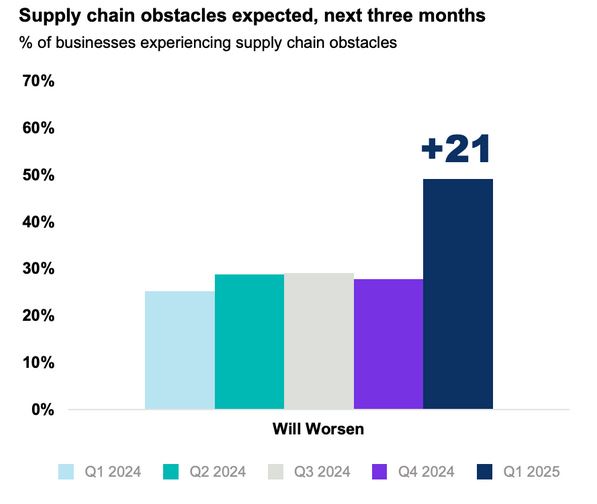

4. Trump will weaponize uncertainty and impose tariffs on Canada’s exports

My base case for 2025 is that Trump will impose tariffs on Canadian exports, almost immediately after his inauguration. Our BDL modelling suggests such a move would be disastrous for North America’s economy. However, looking further down the road, I have much more conviction that the economic ties that bind us together will be strong enough that ultimately a trilateral North American trade pact will continue after Trump’s second term ends.

5. Bank of Canada will continue cutting rates and the dollar will depreciate further

The Bank cut rates at its last five meetings of 2024, bringing its policy rate down from 5% to 3.25%. Financial markets have priced in a few more rate cuts, bottoming out around 2.6%. If the tariff threat is realized, short-term Canadian interest rates need to go much lower to support activity. Given a diverging outlook for monetary policy relative to the US, the Canadian dollar would have further to fall, which will partially cushion the blow, but that will raise import prices and make Canadians rethink their travel plans to the US this year.

6. Canadian trade will initially outperform expectations

The unfortunate experience of steel and aluminum tariffs in Trump’s first term offer some guidance. There was an initial period when businesses “stockpiled” inventories before the tariffs came into force. We expect a similar dynamic this time around.

As such, I expect Canadian exports to outperform expectations, at least very early in 2025, as US importers rush to avoid potential tariffs.

7. Housing prices will rise again

With lower borrowing costs, combined with new mortgage rules to extend amortizations, along with the painfully slow process to raise housing supply, I expect average home prices in Canada to rise in 2025, causing more concern for first-time home buyers. New record highs in the next few years shouldn’t be ruled out.

8. Canadian productivity will be less awful

I’ll end with a mildly optimistic outlook for Canada’s productivity.

Canadians are working harder, not smarter. We’re putting in more hours. Unfortunately, output growth isn’t keeping pace. The result is less output produced per hour. Here’s hoping that this year, with lower borrowing costs, businesses and workers will ambitiously invest in new technologies to uncover better, faster and cheaper ways to create value. It’s desperately needed and something everyone can raise a glass to!